Understanding the components of homeowners insurance premiums is key to securing the right coverage at the best price. It’s more than just a monthly bill; it’s a financial safety net protecting your biggest investment. This deep dive will unravel the mysteries behind those premium calculations, revealing the surprising factors that influence your cost, from your location’s risk profile to the quirks of your own home.

We’ll explore how location, home features, your personal profile, and even your credit score play a crucial role in determining your premium. We’ll break down deductibles, coverage limits, and those tempting add-on options, helping you make informed decisions to safeguard your home and your wallet. Get ready to become a homeowners insurance expert!

Defining Homeowners Insurance Premiums: Understanding The Components Of Homeowners Insurance Premiums

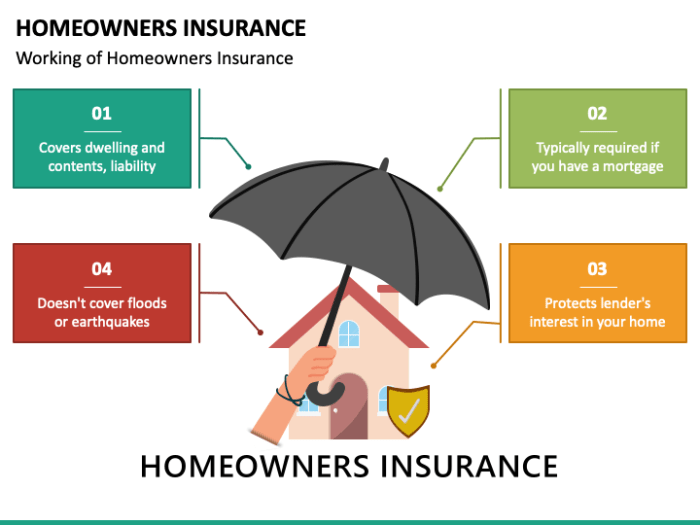

Homeowners insurance premiums are the monthly or annual payments you make to an insurance company in exchange for financial protection against potential losses to your property. Think of it as a safety net, providing peace of mind knowing that if something unforeseen happens – a fire, a storm, or even a lawsuit – you’re financially covered. Understanding what influences these premiums is key to securing the right coverage at the best possible price.The base cost of your homeowners insurance premium is determined by a complex interplay of factors.

Your location plays a significant role; areas prone to natural disasters like hurricanes, earthquakes, or wildfires will generally command higher premiums due to increased risk. The age and condition of your home are also crucial; older homes might require more extensive repairs, leading to higher premiums. The type of construction materials, the presence of security systems, and even your credit score can influence the final cost.

Essentially, insurers assess your risk profile to determine how likely you are to file a claim.

Factors Influencing Homeowners Insurance Premiums

Several key factors contribute to the calculation of your homeowners insurance premium. These include your home’s location, its age and condition, the coverage amount you select, your deductible, and your claims history. A home in a high-risk area, for instance, will naturally carry a higher premium than a similar home in a low-risk area. Similarly, a poorly maintained home will be considered riskier and therefore more expensive to insure than a well-maintained one.

The amount of coverage you choose also directly impacts the premium; more coverage equals higher premiums. A higher deductible, while meaning you pay more out-of-pocket in case of a claim, can lower your premium. Finally, a history of filing claims can increase your premiums, as it signals a higher risk to the insurer.

Types of Coverage in a Standard Homeowners Insurance Policy

A standard homeowners insurance policy typically includes several types of coverage. Dwelling coverage protects the physical structure of your home. Other structures coverage extends to detached structures on your property, such as a garage or shed. Personal property coverage protects your belongings inside and outside your home. Liability coverage protects you financially if someone is injured on your property or if you cause damage to someone else’s property.

Additional living expenses coverage helps cover temporary housing and living costs if your home becomes uninhabitable due to a covered event.

Comparison of Coverage Limits for Various Policy Types

The coverage limits offered vary depending on the type of policy and the insurer. Below is a simplified comparison; actual limits can vary significantly.

| Policy Type | Dwelling Coverage | Other Structures Coverage | Personal Property Coverage |

|---|---|---|---|

| Basic | $100,000 | $10,000 | $50,000 |

| Broad | $200,000 | $20,000 | $100,000 |

| Comprehensive | $300,000 | $30,000 | $150,000 |

| Luxury Home | $500,000+ | $50,000+ | $250,000+ |

The Role of Location in Premium Calculation

Your home’s location is a major factor influencing your homeowners insurance premium. Insurers assess risk based on various geographical elements, ultimately impacting the cost of your coverage. Understanding this relationship is crucial for budgeting and finding the best insurance deal.Insurers meticulously analyze geographic data to predict potential claims. This involves considering the frequency and severity of events like fires, floods, earthquakes, and hurricanes.

Areas prone to these natural disasters will naturally command higher premiums due to the increased likelihood of significant payouts by the insurance company. This risk assessment isn’t just about the immediate surroundings; it extends to broader factors like proximity to fire-prone forests, floodplains, or fault lines.

Natural Disaster Risk and Premium Costs

The impact of natural disasters on premium costs is significant and directly proportional to the risk. Coastal regions facing hurricane threats, for instance, often see drastically higher premiums than inland areas. Similarly, regions situated near active fault lines experience elevated premiums due to the earthquake risk. The higher the probability and potential severity of a natural disaster, the greater the financial burden on the insurer, leading to a corresponding increase in premiums to offset potential losses.

This is why areas with a history of frequent wildfires may see significantly higher premiums than those with minimal wildfire risk.

Premium Rate Comparison: High-Risk vs. Low-Risk Areas

A stark contrast exists between homeowners insurance premiums in high-risk versus low-risk areas. High-risk areas, characterized by frequent natural disasters or high crime rates, often bear significantly higher premiums. This reflects the increased probability of claims and the potential for substantial payouts by the insurance company. Conversely, low-risk areas, with a history of fewer claims and lower incident rates, enjoy lower premiums.

The difference can be substantial, sometimes amounting to hundreds or even thousands of dollars annually. This variation underscores the importance of considering location when budgeting for homeowners insurance.

Hypothetical Premium Difference Scenario

Let’s consider two hypothetical locations: Location A, a coastal town in Florida with a history of hurricanes, and Location B, a suburban community in Iowa with minimal natural disaster risk. Assume both locations have similar-sized, similarly constructed homes with comparable coverage levels. Location A, due to its high hurricane risk, might face an annual premium of $3,000, while Location B, with its low risk profile, might only pay $1,000 annually.

This $2,000 difference vividly illustrates the significant impact of location on homeowners insurance costs. This disparity highlights the crucial role of location in determining premium rates and underscores the need for careful consideration of geographic risk when purchasing homeowners insurance.

Home Characteristics and Premium Costs

Your home’s characteristics are a significant factor in determining your homeowners insurance premium. Insurers assess various aspects of your property to gauge the risk involved in insuring it. Understanding these factors can help you make informed decisions about your home and your insurance coverage.Your home’s physical attributes play a crucial role in calculating your premium. Factors like age, size, construction materials, and security systems all contribute to the overall risk assessment.

A detailed evaluation of these elements allows insurers to accurately reflect the potential cost of repairs or replacements in case of damage or loss.

Understanding your homeowners insurance premium involves factors like location, coverage, and your claims history. Similarly, auto insurance premiums are also influenced by several key variables; learning how to control these can save you money, so check out this guide on how to lower my car insurance premiums significantly for some helpful tips. Applying similar strategies to your home insurance could also lead to lower premiums in the long run.

Home Age, Size, and Construction Materials

Older homes generally present a higher risk due to potential wear and tear, outdated building codes, and increased vulnerability to damage from storms or other natural disasters. For example, a 100-year-old Victorian home might require more extensive and costly repairs than a newly constructed home. Similarly, larger homes often command higher premiums simply because the potential cost of rebuilding or repairing them is greater.

The type of construction materials also plays a significant role. Homes built with fire-resistant materials, such as brick or concrete, typically receive lower premiums compared to those constructed with wood, which is more susceptible to fire damage. A home built with modern, energy-efficient materials might also qualify for discounts.

The Impact of Home Security Systems

Installing a comprehensive home security system can significantly reduce your homeowners insurance premium. Features like alarm systems, fire detectors, and security cameras demonstrate a proactive approach to risk mitigation. Insurers recognize this reduced risk and often reward homeowners with discounts. The discount amount varies depending on the specific features of the security system and the insurer’s policies.

For instance, a system with 24/7 monitoring and integrated fire detection might earn a more substantial discount than a basic alarm system.

Factors Influencing Premiums: A Ranked Overview

The following list prioritizes factors influencing homeowners insurance premiums based on their general impact. Note that the precise weight of each factor can vary based on location, insurer, and specific circumstances.

- Location: This is usually the most significant factor, considering factors like crime rates, proximity to fire hydrants, and risk of natural disasters.

- Home Age and Construction: Older homes and those constructed with less durable materials generally carry higher premiums.

- Home Size and Value: Larger and more expensive homes inherently represent a higher insurance cost.

- Home Security Systems: Effective security systems can lead to significant premium reductions.

- Coverage Amount and Deductible: Higher coverage amounts and lower deductibles result in higher premiums.

- Claim History: A history of insurance claims can increase future premiums.

The Impact of the Homeowner’s Profile

Your homeowner’s insurance premium isn’t just about your house; it’s also a reflection of you. Insurance companies meticulously assess your risk profile, considering various personal factors that influence the likelihood of filing a claim. This assessment impacts the final cost significantly, making understanding these factors crucial for securing the best possible rate.

Credit Score’s Influence on Homeowners Insurance Premiums

Many insurance companies use credit-based insurance scores to help determine your risk. A higher credit score generally correlates with a lower premium. This is because individuals with good credit history tend to demonstrate responsible financial behavior, suggesting a lower likelihood of filing fraudulent claims or failing to maintain their property adequately. Conversely, a lower credit score might lead to higher premiums as insurers perceive a greater risk.

The exact impact varies by state and insurer, but it’s a significant factor for many. For instance, a homeowner with an excellent credit score (750+) might receive a significantly lower premium compared to someone with a fair score (660-699), potentially saving hundreds of dollars annually.

Claims History and Premium Costs

Your past claims history is a major determinant of your future premiums. Filing multiple claims, especially for incidents deemed preventable, can significantly increase your premiums. Insurers view frequent claims as indicators of higher risk, leading them to charge more to cover potential future losses. Conversely, a clean claims history often translates to lower premiums, rewarding responsible homeowners. For example, a homeowner who has never filed a claim might receive a substantial discount compared to someone with a history of several claims, even if those claims were covered.

This reflects the insurer’s assessment of the homeowner’s risk profile.

Premiums for Varying Levels of Insurance Coverage

The amount of coverage you choose directly affects your premium. Higher coverage limits mean higher premiums, as the insurer is assuming a greater financial responsibility. Conversely, choosing lower coverage limits can result in lower premiums, but it also means less financial protection in case of a significant loss. Homeowners should carefully weigh the cost of premiums against the level of protection needed, considering factors like the value of their home and personal belongings.

For instance, choosing a policy with a high replacement cost value for the dwelling will result in a higher premium than selecting a policy with a lower replacement cost value. This is a trade-off between affordability and comprehensive coverage.

Assessing a Homeowner’s Risk Profile

Insurance companies employ sophisticated algorithms and underwriting processes to assess risk. This involves a comprehensive review of various factors, including credit score, claims history, the age and condition of the home, its location, and the homeowner’s security measures. The combination of these factors creates a risk profile, which determines the premium. A homeowner with a low credit score, a history of claims, and a home located in a high-risk area will likely receive a higher premium compared to a homeowner with a good credit score, a clean claims history, and a home located in a low-risk area with robust security features.

This holistic assessment ensures that premiums accurately reflect the individual risk associated with each policy.

Understanding Deductibles and Coverage Limits

Choosing the right homeowners insurance policy involves carefully considering deductibles and coverage limits—two crucial elements that significantly impact your premium and out-of-pocket expenses in case of a claim. Understanding their interplay is key to securing adequate protection without overspending.Deductibles and coverage limits are inversely related to your premium cost. A higher deductible means you’ll pay less upfront for your insurance, as the insurer’s risk is reduced.

Conversely, a lower deductible leads to a higher premium, reflecting the increased likelihood of the insurer covering smaller claims. Coverage limits define the maximum amount your insurance company will pay for a specific type of loss, such as damage to your home’s structure or your personal belongings. Choosing the right balance between deductible and coverage limit is essential for financial security.

Deductibles and Premium Costs, Understanding the components of homeowners insurance premiums

The relationship between deductibles and premiums is straightforward: higher deductibles translate to lower premiums, and vice-versa. This is because a higher deductible signifies you’re willing to absorb more of the cost in case of a claim. The insurance company, therefore, assumes less risk and charges a lower premium to reflect this. For example, a homeowner choosing a $1,000 deductible might pay $100 less annually than someone with a $500 deductible.

The exact difference varies based on several factors, including your location, home value, and coverage options. It’s essential to weigh the potential savings on premiums against the increased out-of-pocket expense should you need to file a claim.

Types of Coverage Limits

Homeowners insurance policies typically include several types of coverage, each with its own limit. These limits dictate the maximum amount the insurer will pay for covered losses within each category. Common coverage limits include:

- Dwelling Coverage: This covers damage to the physical structure of your home, including the attached structures like a garage. The limit represents the maximum payout for repairs or rebuilding.

- Other Structures Coverage: This covers detached structures on your property, such as a fence or shed, up to a specified limit.

- Personal Property Coverage: This covers your belongings, both inside and outside your home, up to a certain limit. This typically includes furniture, clothing, electronics, and more.

- Liability Coverage: This protects you financially if someone is injured on your property or if you accidentally damage someone else’s property. The limit represents the maximum amount the insurer will pay for legal fees and settlements.

- Loss of Use Coverage: This covers additional living expenses if your home becomes uninhabitable due to a covered event, such as a fire. The limit sets the maximum amount the insurer will pay for temporary housing, meals, and other expenses.

Impact of Deductibles and Coverage Limits on Overall Cost

Let’s illustrate with an example. Imagine two homeowners, both with similar homes and locations.Homeowner A chooses a $1,000 deductible and $250,000 dwelling coverage. Their annual premium might be $1,200.Homeowner B opts for a $500 deductible and $300,000 dwelling coverage. Their annual premium might be $1,400.If a $10,000 covered event occurs, Homeowner A’s out-of-pocket expense would be $1,000 (deductible) + $0 (assuming coverage limit is not reached), while Homeowner B’s would be $500.

However, Homeowner B paid $200 more annually in premiums. The choice depends on individual risk tolerance and financial circumstances.

Calculating Potential Out-of-Pocket Expenses

Calculating potential out-of-pocket expenses is straightforward. The formula is:

Out-of-Pocket Expense = Deductible + (Total Loss – Coverage Limit)

Note that the “(Total Loss – Coverage Limit)” portion is only relevant if the total loss exceeds the coverage limit. If the loss is less than the coverage limit, this part of the equation becomes zero. For example, if your total loss is $8,000, your deductible is $1,000, and your coverage limit is $100,000, your out-of-pocket expense would be $1,000.

If the total loss were $150,000 with the same deductible and a $100,000 coverage limit, your out-of-pocket expense would be $1,000 + ($150,000 – $100,000) = $51,000.

Additional Coverage Options and Their Costs

Homeowners insurance provides a basic level of protection, but many additional coverages are available to tailor your policy to your specific needs and increase your peace of mind. These add-ons come at an extra cost, of course, but the added security can be invaluable in certain situations. Understanding these options and their associated costs is crucial for making informed decisions about your insurance coverage.Adding extra coverage often depends on several factors, primarily the risk involved and the value of your possessions.

Insurers assess these risks individually, meaning costs vary widely depending on your specific circumstances and location. This means a thorough understanding of your individual needs and the potential financial impact of unforeseen events is vital before deciding on additional coverage.

Flood Insurance

Flood insurance is frequently sold separately from standard homeowners insurance because floods are typically excluded from standard policies. The cost of flood insurance is determined by factors such as your home’s location within a flood zone, the elevation of your home, and the value of your property. Homes in high-risk flood zones naturally command higher premiums. For instance, a home located in a designated high-risk flood zone in a coastal area might pay significantly more for flood insurance than a similar home located in a low-risk inland area.

The benefit is clear: protection against potentially catastrophic flood damage, which can easily exceed the value of a homeowner’s savings.

Earthquake Insurance

Similar to flood insurance, earthquake insurance is often a separate policy. Premium costs are heavily influenced by your home’s location within a seismically active zone and the construction type of your home. Homes built with materials less resistant to seismic activity will generally have higher premiums. A home in California’s earthquake-prone San Andreas Fault zone will naturally have a much higher premium than a comparable home located in a state with minimal seismic activity.

The benefit lies in the financial protection against the significant structural damage an earthquake can cause. Rebuilding costs after a major earthquake can easily reach millions of dollars.

Personal Liability Umbrella Policy

A personal liability umbrella policy provides extra liability coverage beyond what’s included in your homeowners or auto insurance. This coverage protects you against lawsuits and judgments resulting from accidents or injuries that occur on your property or involve your actions. The cost of this coverage is usually relatively low compared to the potential financial protection it offers. Factors influencing cost include your existing liability limits, your driving record, and your claims history.

The benefit is substantial: protection against potentially devastating legal costs and judgments that could exceed your primary insurance coverage. For example, a single lawsuit resulting from a serious accident could easily cost hundreds of thousands of dollars.

Scheduled Personal Property Coverage

Standard homeowners insurance covers personal property, but it often has limits and may not adequately cover high-value items. Scheduled personal property coverage allows you to individually insure valuable items such as jewelry, artwork, or collectibles, providing more comprehensive protection and higher coverage limits. The cost of this coverage is determined by the value and type of items being insured, as well as their susceptibility to theft or damage.

A collection of rare stamps would command a higher premium than a standard set of kitchenware. The benefit lies in ensuring that your most valuable possessions are fully insured against loss or damage.

Factors Affecting Premium Changes Over Time

Homeowners insurance premiums aren’t static; they fluctuate based on a variety of factors, some predictable, others less so. Understanding these influences is crucial for budgeting and planning. These changes can significantly impact your annual expenses, so staying informed is key.Inflation’s Impact on Homeowners Insurance PremiumsInflation directly affects the cost of repairing or rebuilding a home after damage. As the price of building materials, labor, and other related services rises, so too does the cost of insurance coverage.

Insurance companies must adjust premiums to reflect these increased replacement costs to ensure they can adequately cover claims. For example, a 5% annual inflation rate might translate to a gradual increase in premiums over several years to maintain the same level of coverage. This means that even if your home’s value remains the same, your premium might increase to compensate for the rising cost of repairs.

Changes in Risk Assessment Models

Insurance companies constantly refine their risk assessment models using sophisticated data analysis and predictive modeling. These models incorporate various factors, from climate change projections and increased frequency of natural disasters to improved understanding of construction techniques and building materials. Changes in these models can lead to premium adjustments, either upward or downward, depending on the assessed risk profile of a particular area or property type.

For example, an area experiencing an increased frequency of wildfires might see higher premiums, reflecting the elevated risk. Conversely, advancements in home security technology could lead to lower premiums for homes equipped with such systems.

Market Conditions and Premium Rates

The insurance market itself is subject to economic fluctuations. Factors such as competition among insurers, investment performance, and overall economic conditions can influence premium rates. A highly competitive market might drive premiums down, while a period of low investment returns or a high volume of claims could lead to increases. For example, during periods of economic uncertainty, insurers may become more conservative, leading to higher premiums to offset potential risks.

Conversely, increased competition can force insurers to offer more competitive rates to attract customers.

Illustrative Premium Changes Over Five Years

Imagine a homeowner with a $200,000 home and an initial annual premium of $1,

Over five years, we might see the following hypothetical changes, reflecting the interplay of inflation, risk assessment, and market conditions:

Year 1: $1,500 (baseline)Year 2: $1,575 (5% increase due to inflation)Year 3: $1,654 (5% increase from Year 2)Year 4: $1,736 (5% increase from Year 3, plus a $10 increase due to updated risk assessment)Year 5: $1,827 (5% increase from Year 4, plus a $20 increase due to a slight tightening of the market)This illustration demonstrates how various factors can cumulatively impact premiums, resulting in a gradual but significant increase over time.

It’s important to note that these are hypothetical figures and actual changes can vary widely depending on specific circumstances.