Relationship between deductible and insurance premiums: It’s a financial dance, a delicate balance between cost and coverage. Understanding this relationship is key to securing the right insurance plan without breaking the bank. Higher deductibles often mean lower premiums, but this comes with the trade-off of shouldering more upfront costs in case of a claim. This article breaks down the complexities, showing you how to navigate the world of deductibles and premiums to find the perfect fit for your needs and budget.

We’ll explore how factors like age, location, and health history influence these costs, and provide clear examples to illustrate different scenarios. From comparing high vs. low deductibles to understanding the impact on your out-of-pocket expenses, we’ll equip you with the knowledge to make informed decisions about your insurance coverage.

The Fundamental Relationship

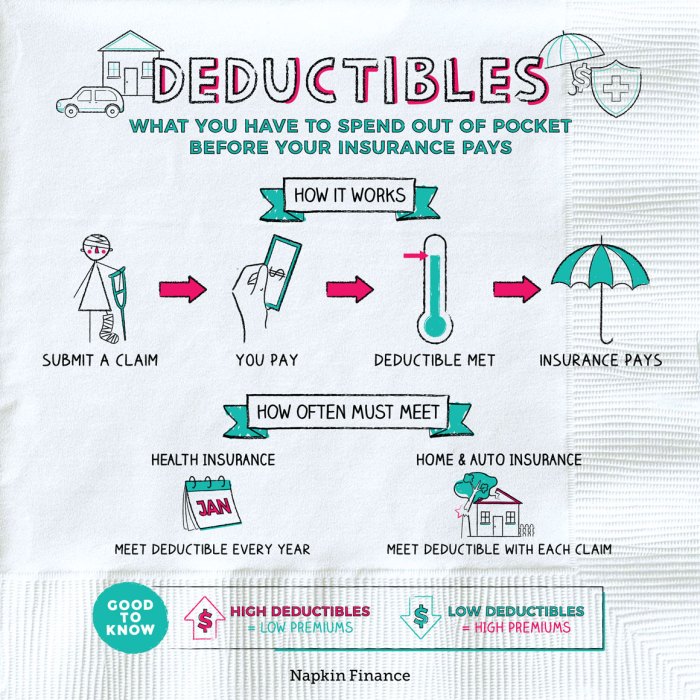

Understanding the connection between your insurance deductible and your premium is key to choosing a plan that fits your budget and risk tolerance. Essentially, they work inversely: a higher deductible typically means a lower premium, and vice versa. This relationship stems from the fundamental principle of risk sharing between you and the insurance company.The inverse relationship between deductibles and premiums is a direct reflection of the amount of risk the insurance company is willing to assume.

A higher deductible signifies you’re willing to shoulder more of the financial burden in case of a claim. Because the insurer’s payout potential is reduced, they can offer a lower premium. Conversely, a lower deductible means the insurer takes on more risk, resulting in a higher premium to compensate for the increased potential payout.

Impact of Higher Deductibles on Insurance Costs

A higher deductible directly translates to lower monthly or annual premiums. This is because the insurance company is less likely to have to pay out a claim, as you will be responsible for covering a larger portion of the costs upfront. The savings can be substantial, particularly for individuals who have a strong emergency fund and are confident they can handle a significant out-of-pocket expense before insurance coverage kicks in.

However, it’s crucial to weigh this potential savings against the increased risk of having to pay a large sum out-of-pocket in case of an accident or illness.

Examples of Deductible and Premium Combinations

The following table illustrates different deductible and premium combinations for various coverage levels. Remember, these are examples and actual costs will vary based on factors such as your age, location, health status (for health insurance), and the specific insurance provider.

| Plan Name | Deductible | Premium (Annual) | Coverage Summary |

|---|---|---|---|

| Basic Plan | $5,000 | $1,200 | Covers most major expenses after the deductible is met. May have higher co-pays and out-of-pocket maximums. |

| Standard Plan | $2,500 | $1,800 | Offers a balance between cost and coverage. Lower deductible than the Basic Plan, resulting in a higher premium. |

| Premium Plan | $1,000 | $2,400 | Provides the most comprehensive coverage with the lowest deductible. This results in the highest premium. |

| High Deductible Plan (with HSA) | $7,500 | $900 | High deductible plan often paired with a Health Savings Account (HSA) to help manage out-of-pocket costs. Contributions to the HSA are tax-deductible. |

Factors Influencing Premium and Deductible

Understanding your insurance premiums and deductibles isn’t just about the numbers; it’s about grasping the factors that shape those costs. Insurance companies use a complex formula, considering numerous elements to assess your risk and determine your personalized rates. This means that two seemingly similar individuals can end up with vastly different premiums and deductibles.

Insurance companies employ sophisticated risk assessment models to predict the likelihood of you filing a claim. This involves analyzing various factors to create a comprehensive profile of your risk. The higher the perceived risk, the higher your premium and potentially your deductible. This system aims to distribute costs fairly, balancing those who are statistically less likely to need coverage with those who might require more frequent claims.

Risk Assessment and its Impact, Relationship between deductible and insurance premiums

Risk assessment forms the cornerstone of premium and deductible determination. Insurance companies meticulously analyze data to identify potential risk factors. This data-driven approach helps ensure that premiums accurately reflect the probability of claims. For instance, a driver with a history of accidents will likely pay more than a driver with a clean record. Similarly, someone living in a high-crime area might face higher home insurance premiums due to an increased risk of burglary or theft.

The goal is to accurately reflect the statistical likelihood of a claim occurring.

Generally, a higher deductible means lower insurance premiums, and vice versa. Want to slash those premiums? Check out this guide on how to lower my car insurance premiums significantly to find more ways to save. Ultimately, understanding the relationship between your deductible and your premium is key to finding the right balance for your budget and risk tolerance.

Age, Location, and Health History Influence

Several key factors significantly influence the final cost of insurance. Your age, location, and health history are particularly important. For example, younger drivers often pay higher car insurance premiums because statistically, they are involved in more accidents. Similarly, those living in areas prone to natural disasters, like hurricanes or earthquakes, will generally pay higher premiums for home or flood insurance.

Health history plays a crucial role in health insurance, with pre-existing conditions often leading to higher premiums.

Illustrative Examples

Let’s consider a few examples to illustrate how these factors interact. A 25-year-old living in a high-crime urban area with a history of speeding tickets will likely pay significantly more for car insurance than a 50-year-old living in a rural area with a clean driving record. Similarly, a smoker with a family history of heart disease will typically pay higher premiums for health insurance compared to a non-smoker with a healthy family history.

These are not arbitrary figures; they are based on statistical analysis of large datasets. The interaction of these factors creates a personalized risk profile that determines the individual’s premium and deductible.

Choosing the Right Balance: Relationship Between Deductible And Insurance Premiums

Finding the sweet spot between your insurance premium and deductible requires careful consideration of your financial situation and risk tolerance. It’s a balancing act: a lower premium means higher out-of-pocket costs upfront, while a higher premium offers more immediate financial protection. Understanding the implications of each choice is crucial for making an informed decision.The core decision revolves around your comfort level with potential out-of-pocket expenses versus the monthly cost of your insurance.

A high deductible plan might seem appealing due to lower premiums, but it shifts a significant portion of the financial burden onto you in case of a claim. Conversely, a low deductible plan provides greater financial security but comes with a higher monthly premium.

High vs. Low Deductibles: A Comparison

Choosing between a high and low deductible is a personal financial decision. Let’s analyze the advantages and disadvantages of each:

The decision hinges on your ability to absorb unexpected medical or other covered expenses. Consider your financial reserves, emergency fund, and overall risk tolerance. A high deductible might be suitable for someone with a healthy emergency fund and a low risk tolerance, while a low deductible is better suited for those with limited savings or a high risk aversion.

Decision-Making Flowchart for Deductible Selection

Imagine a flowchart. The first decision point asks: “Do you have a substantial emergency fund (e.g., 3-6 months of living expenses)?” If yes, the flow continues to: “Are you comfortable with higher out-of-pocket costs in case of a claim?” A “yes” leads to recommending a high deductible plan. A “no” leads to recommending a low deductible plan.

If the answer to the first question is “no”, the flowchart immediately recommends a low deductible plan. This simple flowchart provides a structured approach to the decision-making process.

Pros and Cons of High and Low Deductibles

Weighing the pros and cons is essential before committing to a specific deductible level. This helps in aligning your choice with your financial realities and risk appetite.

- High Deductible Plan:

- Pros: Lower monthly premiums, potential for significant savings if no claims are filed.

- Cons: Higher out-of-pocket costs in the event of a claim, potential financial strain if a significant event occurs.

- Low Deductible Plan:

- Pros: Lower out-of-pocket costs in the event of a claim, greater financial protection and peace of mind.

- Cons: Higher monthly premiums, potentially paying more over time if no claims are filed.

Impact on Claims and Out-of-Pocket Costs

Understanding how deductibles affect your out-of-pocket expenses is crucial for choosing the right insurance plan. A higher deductible means lower premiums, but you’ll pay more upfront before your insurance kicks in. Conversely, a lower deductible means higher premiums, but lower out-of-pocket costs when you need to file a claim. Let’s explore how this plays out in real-world scenarios.The deductible is the amount you pay out-of-pocket before your insurance coverage begins.

Once you’ve met your deductible, your insurance company will typically cover a percentage of the remaining costs, depending on your plan’s co-insurance rate. This means that the size of your claim, relative to your deductible, significantly impacts your total cost.

Deductible Impact on Out-of-Pocket Expenses

Let’s illustrate this with a simple example. Imagine three different deductible plans (A, B, and C) and various claim sizes. We’ll assume, for simplicity, that after the deductible is met, the insurance covers 80% of the remaining costs. This means you will pay 20% of the costs after meeting your deductible.

| Claim Size | Deductible Plan A ($500) | Deductible Plan B ($1000) | Deductible Plan C ($2000) |

|---|---|---|---|

| $500 | $500 | $1000 | $2000 |

| $1500 | $500 + ($1000 – 0.20) = $700 | $1000 + ($500 – 0.20) = $1100 | $2000 |

| $3000 | $500 + ($2500 – 0.20) = $1000 | $1000 + ($2000 – 0.20) = $1400 | $2000 + ($1000 – 0.20) = $2200 |

| $5000 | $500 + ($4500 – 0.20) = $1400 | $1000 + ($4000 – 0.20) = $1800 | $2000 + ($3000 – 0.20) = $2600 |

Note that these calculations only include out-of-pocket expenses related to the deductible and co-insurance. Additional costs like co-pays or premiums are not included in these figures. It is important to factor in these additional costs when comparing plans.

Claim Filing Process and Deductible Application

Filing a claim typically involves contacting your insurance provider, either by phone or online. You’ll need to provide details about the incident, including dates, locations, and any relevant documentation (such as medical bills or repair estimates). Your insurance company will then review your claim and determine the coverage. The deductible is applied first; once it’s met, the remaining costs are subject to your co-insurance percentage.

For example, if your claim is $3000 and your deductible is $500, you pay $500, and the insurance covers 80% of the remaining $2500. You would then be responsible for the remaining 20%, or $500. The total out-of-pocket cost in this scenario would be $1000.

Insurance Policy Types and Their Impact

The relationship between deductibles and premiums isn’t a one-size-fits-all scenario. It varies significantly depending on the type of insurance policy you’re considering. Understanding these differences is crucial for making informed decisions about your coverage and financial protection. Let’s explore how deductibles and premiums interact across various insurance types.Different insurance policies have unique risk profiles, influencing how insurers structure their premiums and deductibles.

Higher-risk policies, like those covering expensive medical procedures or luxury vehicles, typically demand higher premiums, even with higher deductibles. Conversely, lower-risk policies might offer more affordable premiums with manageable deductibles.

Health Insurance Deductibles and Premiums

Health insurance premiums are often influenced by factors like the plan’s coverage level (e.g., bronze, silver, gold, platinum), age, location, and the chosen provider network. Higher premiums usually mean lower deductibles and out-of-pocket maximums, offering more comprehensive coverage upfront. Conversely, lower premiums generally correlate with higher deductibles, meaning you’ll pay more out-of-pocket before the insurance company starts covering expenses.

For example, a high-deductible health plan (HDHP) might have a $5,000 deductible but a lower monthly premium compared to a plan with a $1,000 deductible and a significantly higher premium.

Auto Insurance Deductibles and Premiums

Auto insurance premiums are affected by factors like your driving record, the type of vehicle, your location, and the coverage levels you select. Similar to health insurance, a higher deductible (e.g., $1,000) will typically result in a lower premium compared to a lower deductible (e.g., $250) with a higher premium. If you’re involved in a car accident causing $3,000 in damages, a policy with a $1,000 deductible would require you to pay $1,000 out-of-pocket, while a $250 deductible would only require $250.

Home Insurance Deductibles and Premiums

Home insurance premiums are determined by factors such as the value of your home, its location, the level of coverage you choose, and the presence of security features. A higher deductible will generally lower your premium. For instance, a $1,000 deductible might result in a lower annual premium compared to a $500 deductible. If a fire causes $10,000 in damage to your home, you’d pay $1,000 with the higher deductible and $500 with the lower one.

Impact of a Car Accident on Different Deductibles

Consider a car accident resulting in $5,000 in damages. Under an auto insurance policy with a $500 deductible, the policyholder would pay $500, and the insurer would cover the remaining $4,500. However, with a $1,000 deductible, the policyholder’s out-of-pocket expense would increase to $1,000, leaving the insurer to cover $4,000. This illustrates how a higher deductible shifts more financial responsibility to the policyholder in exchange for lower premiums.

Illustrative Examples

Understanding the interplay between deductibles and premiums requires concrete examples. Let’s explore how different choices impact a hypothetical individual’s healthcare costs. We’ll consider Sarah, a 35-year-old freelance graphic designer, who needs health insurance.Sarah’s annual healthcare needs are estimated at $3,000, which includes regular check-ups and potential minor illnesses. However, she also faces the risk of a major health event, which could cost significantly more.

We’ll analyze how different deductible and premium combinations would affect her total cost in various scenarios.

Sarah’s Insurance Scenarios

We’ll examine three different insurance plans with varying deductible and premium structures to illustrate the trade-offs involved.

| Plan | Monthly Premium | Annual Deductible | Scenario 1: Minor Illness ($500) | Scenario 2: Major Illness ($15,000) |

|---|---|---|---|---|

| Plan A (High Deductible) | $150 | $5,000 | $500 (out-of-pocket) + $1800 (premiums) = $2300 | $5000 (deductible) + $10,000 (coinsurance/out-of-pocket) + $1800 (premiums) = $16,800 |

| Plan B (Medium Deductible) | $250 | $2,000 | $500 (out-of-pocket) + $3000 (premiums) = $3500 | $2000 (deductible) + $13,000 (coinsurance/out-of-pocket) + $3000 (premiums) = $18,000 |

| Plan C (Low Deductible) | $400 | $500 | $500 (out-of-pocket) + $4800 (premiums) = $5300 | $500 (deductible) + $14,500 (coinsurance/out-of-pocket) + $4800 (premiums) = $19,800 |

Note: These calculations are simplified and do not include factors like co-insurance percentages or out-of-pocket maximums. Actual costs may vary.

Visual Representation of Deductible, Premium, and Out-of-Pocket Expenses

Imagine a graph with three lines representing the relationship between deductible, premium, and out-of-pocket expenses for a typical insurance claim.The horizontal axis represents the size of the medical claim (from $0 to a high amount). The vertical axis represents the total cost to the insured.The first line (Premium) is a straight, horizontal line representing the total annual premium cost regardless of the claim size.

It remains constant.The second line (Deductible + Premium) starts at the point representing the annual premium on the vertical axis. It then increases sharply at a 45-degree angle until it reaches the deductible amount. After the deductible is met, the line continues to rise but at a shallower angle representing the cost sharing (coinsurance).The third line (Out-of-Pocket Expenses) starts at the same point as the second line but increases sharply up to the deductible amount, then gradually increases after that.

This line represents the total cost to the insured, considering the premium and out-of-pocket expenses after the deductible.The intersection points of these lines illustrate the break-even points where the cost of a higher premium is offset by a lower out-of-pocket expense for larger claims. The visual clearly shows how the choice of deductible affects the overall cost depending on the size of the medical claim.

A higher deductible means a lower premium but higher out-of-pocket costs for larger claims, and vice-versa.