How to compare car insurance premiums from different companies? Navigating the world of car insurance can feel like decoding a secret language. Premiums vary wildly, coverage options seem endless, and deciphering the fine print is enough to give anyone a headache. But fear not, fellow drivers! This guide cuts through the confusion, providing a straightforward approach to comparing car insurance premiums and finding the best policy for your needs and budget.

We’ll break down the key factors influencing costs, show you how to get accurate quotes, and help you analyze policies to make an informed decision.

From understanding the different types of coverage (liability, collision, comprehensive, etc.) to comparing deductibles and premiums, we’ll equip you with the knowledge to confidently compare quotes from various insurance providers. We’ll even cover tips for negotiating lower premiums and highlight potential pitfalls to avoid. By the end of this guide, you’ll be a car insurance comparison pro, ready to save money and secure the right protection.

Understanding Car Insurance Premiums

Choosing the right car insurance can feel overwhelming, especially with the wide range of options and varying costs. Understanding how insurance premiums are calculated is key to making an informed decision and securing the best coverage for your needs without overspending. This section breaks down the factors influencing your premium, the different types of coverage available, and the components that make up your final cost.

Factors Influencing Car Insurance Costs

Several factors contribute to the final price of your car insurance premium. These factors are assessed by insurance companies to determine your risk profile, ultimately impacting how much you pay. Higher-risk drivers generally pay more.

Your driving record plays a significant role. Accidents and traffic violations, particularly serious ones, will increase your premium. The number of years you’ve held a license also matters; newer drivers are often considered higher risk. Your age also impacts premiums; young drivers typically pay more due to statistically higher accident rates. Where you live affects your premium as well; areas with higher crime rates or more frequent accidents generally have higher insurance costs.

The type of car you drive is another crucial factor. Sports cars and luxury vehicles are often more expensive to insure due to higher repair costs and potential for theft. Your annual mileage and how you use your vehicle (commute vs. pleasure driving) also influence your premium. Finally, your credit score can surprisingly affect your insurance rates in some regions, reflecting your perceived financial responsibility.

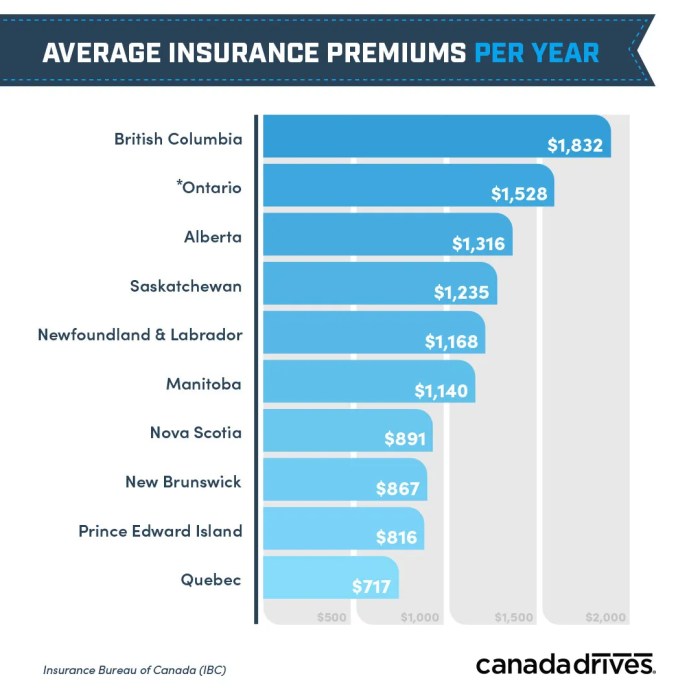

So you’re shopping around for car insurance? Comparing premiums from different companies is key to finding the best deal. Remember, a big factor influencing your quote is your location; check out this article on effect of location on car insurance premium calculations to understand why. Armed with this knowledge, you can confidently compare apples to apples and snag the lowest rate for your needs.

Types of Car Insurance Coverage

Car insurance policies typically offer various coverage options, each designed to protect you in different situations. Understanding these options is essential for choosing the right level of protection.

Liability coverage is crucial and usually legally mandated. It covers damages or injuries you cause to others in an accident. Collision coverage pays for repairs to your vehicle if you’re involved in a collision, regardless of fault. Comprehensive coverage protects your car from non-collision damage, such as theft, vandalism, or weather-related events. Uninsured/Underinsured motorist coverage protects you if you’re involved in an accident with a driver who lacks sufficient insurance.

Medical payments coverage helps pay for medical expenses for you and your passengers, regardless of fault. Personal injury protection (PIP) coverage, often mandated in certain states, covers medical expenses and lost wages for you and your passengers, regardless of fault. The specific coverages and limits offered vary between insurance companies and states.

Common Premium Components

Your car insurance premium is made up of several key components. These components reflect the different risks and costs associated with insuring your vehicle.

The base rate reflects the average cost of insurance for a similar vehicle and driver profile in your area. This is the starting point for calculating your premium. Your driving history, as discussed earlier, significantly impacts the final cost. Additional charges might apply for optional coverage, such as roadside assistance or rental car reimbursement. Administrative fees and taxes are often added to the premium.

Finally, discounts can reduce your overall premium; these might include safe driver discounts, multi-car discounts, or good student discounts. Understanding these components helps you analyze your policy’s value.

Comparison of Car Insurance Coverage Types

| Coverage Type | What it Covers | Typical Cost Impact | Importance |

|---|---|---|---|

| Liability | Damages and injuries caused to others | High (usually mandatory) | Essential |

| Collision | Damage to your vehicle in a collision | Moderate to High | Important if you have a loan or lease |

| Comprehensive | Non-collision damage (theft, vandalism, weather) | Moderate | Helpful for added protection |

| Uninsured/Underinsured Motorist | Accidents with uninsured drivers | Moderate | Important for added protection |

Gathering Quotes from Different Companies

Shopping for car insurance can feel like navigating a maze, but securing the best rates doesn’t have to be a headache. Understanding how to effectively gather quotes from different companies is the first step towards saving money on your premiums. This involves utilizing various methods, providing accurate information, and comparing the processes of different insurers.Getting quotes from multiple car insurance providers is crucial for finding the best deal.

By comparing apples to apples, you can identify the company offering the most comprehensive coverage at the most competitive price. This process often involves online quote tools, phone calls, or even in-person visits to insurance agencies. Each method has its own set of advantages and disadvantages.

Online Quote Request Methods

Many major insurance providers offer user-friendly online quote tools. These tools allow you to quickly input your information and receive an instant estimate of your premium. This method is convenient and allows for easy comparison shopping. To obtain accurate quotes, you’ll need to provide information such as your driving history (including accidents and violations), vehicle details (make, model, year), address, and desired coverage levels (liability, collision, comprehensive, etc.).

Providing accurate information is vital; inaccurate details can lead to inaccurate and potentially misleading quotes.

Comparison of Quote Request Processes

Let’s examine the quote request processes of three major insurance providers: Geico, Progressive, and State Farm. While specifics may vary slightly over time, the general process remains consistent.Geico’s online quote process is known for its speed and simplicity. Users input basic information, and the system generates a quote almost instantly. Progressive offers a similar streamlined online experience, often incorporating features like a snapshot device to monitor driving habits for potential discounts.

State Farm’s online process is more detailed, requiring more comprehensive information upfront, which may take slightly longer but often results in a more tailored quote.

Advantages and Disadvantages of Different Quote Gathering Methods

The effectiveness of each method depends on individual preferences and circumstances.

- Online Quotes:

- Advantages: Convenient, fast, allows for easy comparison shopping, available 24/7.

- Disadvantages: May not capture all nuances of your individual situation, potential for inaccurate information if input is incorrect.

- Phone Quotes:

- Advantages: Allows for clarification of complex situations, personalized service.

- Disadvantages: Can be time-consuming, less convenient than online methods, availability may be limited by business hours.

- In-Person Quotes:

- Advantages: Face-to-face interaction allows for detailed discussions, personalized advice.

- Disadvantages: Least convenient method, requires scheduling an appointment, may not offer significant advantages over other methods for simple situations.

Comparing Insurance Quotes

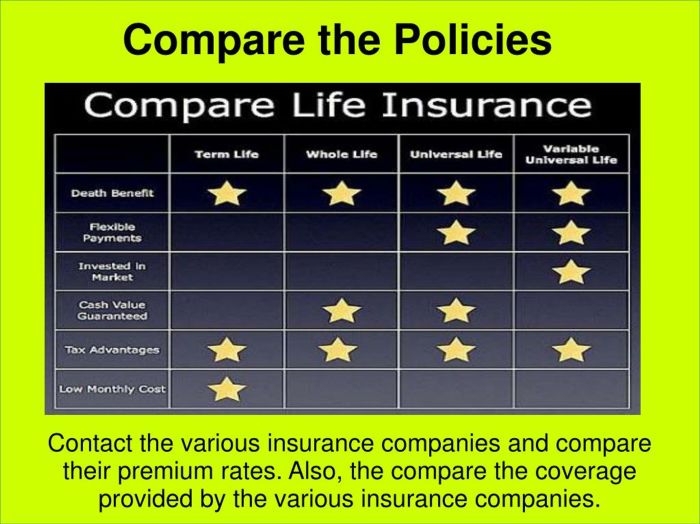

So, you’ve gathered quotes from several car insurance companies. Now comes the crucial part: comparing apples to apples (or should we say, policies to policies?). Don’t just focus on the bottom line; a lower premium might mean significantly less coverage, leaving you vulnerable in case of an accident. This section will guide you through effectively comparing your quotes to find the best fit for your needs and budget.

Comparing car insurance quotes requires careful attention to detail. You’re not just looking for the cheapest option; you’re seeking the best value – the optimal balance between cost and comprehensive protection. Understanding the nuances of coverage, deductibles, and policy features is key to making an informed decision.

Key Coverage Differences

Different insurance companies offer varying levels of coverage within each category. For instance, one company’s liability coverage might include higher limits than another’s, offering greater financial protection in the event of an accident you cause. Similarly, collision and comprehensive coverage can vary in terms of what’s included and excluded. Some may offer rental car reimbursement, roadside assistance, or other add-ons not present in other policies.

Always scrutinize the policy documents to understand exactly what each company is offering. Don’t rely solely on the summary provided with the quote.

Deductibles and Premiums: A Balancing Act

Your deductible is the amount you pay out-of-pocket before your insurance coverage kicks in. A higher deductible typically leads to a lower premium, while a lower deductible results in a higher premium. The ideal balance depends on your risk tolerance and financial situation. Can you comfortably afford a higher deductible in exchange for lower monthly payments? Consider your savings and emergency fund when making this decision.

For example, a $500 deductible might seem manageable, but a $2,000 deductible could be financially crippling after an accident.

Organizing Quotes for Comparison

To simplify the comparison process, create a table summarizing the key features and costs of each quote. This visual representation makes it easy to identify the best deal.

| Company | Monthly Premium | Liability Coverage | Deductible (Collision) |

|---|---|---|---|

| Company A | $100 | $100,000/$300,000 | $500 |

| Company B | $120 | $250,000/$500,000 | $1000 |

| Company C | $90 | $50,000/$100,000 | $250 |

| Company D | $115 | $100,000/$300,000 | $1000 |

Note: Liability coverage is expressed as bodily injury/property damage limits. For example, $100,000/$300,000 means up to $100,000 per person injured and $300,000 total for all injuries in an accident you cause.

When Higher Premiums Are Justified

Sometimes, a higher premium reflects superior coverage that’s worth the extra cost. For example, if one company offers significantly higher liability limits, uninsured/underinsured motorist coverage, or comprehensive coverage with fewer exclusions, the added expense might be justified, particularly for high-value vehicles or those with high-risk driving profiles. Consider a scenario where you cause an accident resulting in significant injuries.

A policy with lower liability limits could leave you personally liable for substantial medical bills exceeding your coverage, while a higher-limit policy would offer better protection.

Analyzing Policy Details: How To Compare Car Insurance Premiums From Different Companies

Choosing the cheapest car insurance isn’t always the smartest move. A deeper dive into the policy details reveals crucial differences that can significantly impact your experience in case of an accident or claim. Don’t just focus on the premium; understand what you’re actually paying for.

Claims Processes

Understanding how each insurance company handles claims is paramount. A smooth, efficient claims process can save you time, stress, and potentially money. Look for companies with clear, easily accessible claim filing procedures, online portals for tracking progress, and dedicated claims adjusters who are responsive and helpful. Some companies might boast 24/7 claims support, while others may have limited operating hours.

Consider the average claim settlement time provided by independent review sites, as this is a strong indicator of efficiency. For example, a company with a consistently faster claim settlement time might be preferable, even if its premium is slightly higher.

Customer Service Features

Exceptional customer service can make all the difference, especially during stressful situations like accidents. Investigate the availability of various customer service channels – phone, email, online chat, and even in-person support. Check for customer reviews and ratings regarding responsiveness, helpfulness, and overall satisfaction with the customer service team. Features like online account management, mobile apps for managing policies and filing claims, and proactive communication from the insurer regarding policy updates can significantly enhance the customer experience.

Consider whether 24/7 customer support is important to you, and whether the company provides multilingual support if needed.

Policy Exclusions and Limitations

Policy documents, while often dense, contain crucial information about what is and isn’t covered. Carefully review each policy’s exclusions and limitations. This includes understanding deductibles (the amount you pay out-of-pocket before insurance coverage kicks in), coverage limits (the maximum amount the insurance company will pay for a claim), and specific exclusions, such as certain types of damage or driving situations.

For instance, some policies might exclude coverage for damage caused by driving under the influence, while others may have limitations on rental car coverage. A thorough understanding of these aspects is crucial to avoid unpleasant surprises later.

Customer Satisfaction Ratings

Independent rating agencies and review platforms regularly assess customer satisfaction with various insurance companies. These ratings offer a valuable perspective beyond the advertised features and premiums. Consider using these ratings as a supplementary tool in your comparison.

| Company | Customer Satisfaction Score (Example) | Claims Handling Speed (Example) | Customer Service Responsiveness (Example) |

|---|---|---|---|

| Company A | 4.5/5 | Average 7 days | Highly Responsive |

| Company B | 4.2/5 | Average 10 days | Mostly Responsive |

| Company C | 3.8/5 | Average 14 days | Average Responsiveness |

| Company D | 4.0/5 | Average 9 days | Good Responsiveness |

Making an Informed Decision

Choosing the right car insurance policy isn’t just about finding the cheapest option; it’s about finding the best coverage for your needs and budget. This involves carefully weighing different factors, negotiating effectively, and understanding the true value of each policy. Making a well-informed decision ensures you’re adequately protected without overspending.

Choosing the Best Car Insurance Policy, How to compare car insurance premiums from different companies

Selecting the optimal car insurance policy requires a systematic approach. First, review your needs. Do you need comprehensive coverage, or will liability insurance suffice? Consider your driving history, the value of your car, and your personal risk tolerance. Then, compare quotes from different insurers, paying close attention to deductibles and coverage limits.

Finally, choose the policy that offers the best balance of coverage, price, and customer service. For example, a young driver with a less valuable car might prioritize liability coverage and a higher deductible to lower premiums, while an older driver with a luxury vehicle might opt for comprehensive coverage with a lower deductible.

Negotiating Lower Premiums

Don’t be afraid to negotiate! Insurance companies often have some wiggle room in their pricing. Start by comparing quotes and highlighting lower premiums offered by competitors. Inquire about discounts for safe driving records, bundling policies (home and auto), or taking defensive driving courses. For instance, mentioning a competitor’s quote that’s $100 lower annually could prompt your current insurer to match or offer a better deal.

Loyalty can also be a bargaining chip – being a long-term customer can sometimes sway an insurer to offer a better rate.

Evaluating Policy Value Propositions

The cheapest policy isn’t always the best value. Consider the coverage limits, deductibles, and additional features offered. A policy with slightly higher premiums might offer significantly better coverage in case of an accident. For example, a policy with a lower deductible might save you thousands of dollars out-of-pocket in the event of a claim, even if the premium is higher.

Evaluate the value proposition by comparing the total cost (premium + potential out-of-pocket expenses) across different policies with varying coverage levels. A simple cost-benefit analysis can help determine which policy provides the best protection for your investment.

Car Insurance Policy Checklist

Before committing to a policy, use this checklist to ensure you’ve considered all essential aspects:

- Coverage types (liability, collision, comprehensive, etc.) and limits.

- Deductibles (amount you pay before insurance coverage kicks in).

- Premium cost (monthly or annual).

- Discounts offered (safe driver, bundling, etc.).

- Customer service ratings and reviews.

- Claims process details.

- Policy terms and conditions.

- Payment options.

This checklist helps ensure you’re making a well-informed decision, considering both the immediate cost and the long-term value of the insurance policy. By carefully reviewing each item, you can select the best protection for your car and your financial well-being.

Illustrative Examples

Understanding car insurance premiums requires looking beyond the bottom line. Let’s explore scenarios illustrating how seemingly high or low premiums can reflect different levels of coverage and risk. These examples will highlight the importance of carefully comparing policy details before making a decision.

Higher Premium Justified by Broader Coverage

Imagine Sarah, a young professional who recently purchased a brand new luxury SUV. She opts for a comprehensive insurance policy with high liability limits, uninsured/underinsured motorist coverage, collision, and comprehensive coverage, including roadside assistance. Her premium is significantly higher than her friend Mark’s, who drives an older, less valuable sedan with basic liability coverage. However, Sarah’s higher premium reflects the significantly broader protection she receives.

In the event of an accident, Sarah’s policy would cover extensive vehicle repairs or replacement, significant medical expenses for herself and others involved, and legal fees if she’s sued. Mark’s policy would offer much less protection, leaving him potentially liable for substantial costs in the case of a serious accident. This illustrates that a higher premium can translate to significantly greater financial security.

Lower Premium Involving Significant Risk

Conversely, consider Mark’s situation. His lower premium comes with a considerable level of risk. His basic liability coverage only protects him against claims for injuries or damages he causes to others. If he’s at fault in an accident causing significant damage to another vehicle or serious injuries, he could face substantial personal financial liability. His own vehicle repairs or replacement would not be covered, and he’d lack the additional protection offered by features like roadside assistance or rental car reimbursement.

This highlights the importance of understanding the trade-off between premium cost and the level of protection afforded. A lower premium doesn’t necessarily mean a better deal; it can indicate limited coverage and increased personal risk.

Hypothetical Insurance Policy: Strengths and Weaknesses

Let’s analyze a hypothetical policy from “SecureDrive Insurance.” This policy offers $100,000/$300,000 bodily injury liability, $50,000 property damage liability, collision coverage with a $500 deductible, comprehensive coverage with a $250 deductible, uninsured/underinsured motorist coverage, and roadside assistance. A strength of this policy is its comprehensive coverage, providing good protection against various accident scenarios. The relatively low deductibles also minimize out-of-pocket expenses in the event of a claim.

However, a weakness might be the liability limits, which could be insufficient in a serious accident involving significant injuries or property damage. Higher liability limits, while increasing the premium, would offer greater financial protection. Another potential weakness depends on the specific pricing; if the premium is significantly higher than comparable policies from other companies offering similar coverage, it might not represent the best value.

Impact of Coverage Levels on Cost

This text-based table illustrates how different coverage levels impact the overall cost of car insurance. Assume a base premium of $500.| Coverage Level | Additional Cost | Total Premium ||—————————–|—————–|—————-|| Basic Liability Only | $0 | $500 || + Collision Coverage | $100 | $600 || + Comprehensive Coverage | $150 | $750 || + Uninsured/Underinsured | $75 | $825 || + Higher Liability Limits | $125 | $950 || + Roadside Assistance | $25 | $975 |This table demonstrates that adding coverage layers increases the total premium.

The choice depends on individual risk tolerance and financial capabilities.